Want to Invest in Real Estate?

8 things to Think About

Investing in Real Estate can seem daunting because it’s complicated and there is a lot to learn and understand. The good news is you don’t have to know it all! There are plenty of people with specialist knowledge to help you on your journey. But what you DO need to have is a goal, a vision, a North Star – whatever you want to call it. Taking stock of your interests and objectives will help you cut through the noise and let you hone in on what’s important to you. It will also help you ‘course correct’ should things take a turn or life hands you some setbacks.

When it comes to building wealth through real estate, here are 8 key things you should think about as you get started:

01

Your ‘Why’

Like a gazillion Instagram posts out there, I’m suggesting that you explore what moves you, makes you do what you do, your ‘Why’. Understanding why you TRULY want to build a portfolio of properties will help your decision-making and getting through the difficult moments when you feel like giving up. (If you don’t already know about ‘Start with Why‘ you can check out the OG himself Simon Sinek)

02

Portfolio Goals

How many properties do you want? Are you looking for a second home for your family like a cottage or condo in the city? Do you want a few rental properties to build equity and some income? Or are you looking to grow a portfolio of more than 5 buildings? Having some idea about how big you want to grow your portfolio will help you make wise decisions about financing, taxes and other matters.

03

How Active do you want to be?

There are many ways to be involved in investing. Think about how ‘ACTIVE‘ you want to be? Do you like: buying? renovating? managing properties? managing tenants? Maybe you even want to learn more about investing itself?

Those aren’t your only options – you can also be a ‘PASSIVE‘ investor. You might just want to be the owner on title and do nothing else. Or you might just want to invest your money in property projects earning interest and profits with no property ownership.

04

What Returns do you want/NEED?

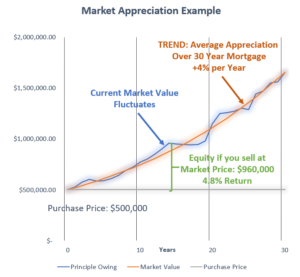

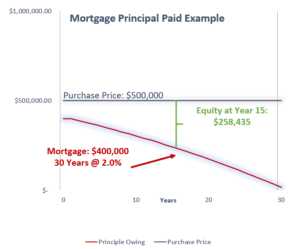

Real Estate essentially provides returns in 3 ways: market appreciation, equity from principle paid, rental income (read more). Are you looking for income? Do you want to grow a perpetual income stream? Maybe your current tax situation would be improved by structuring returns through equity instead of income.

05

How will you fund it?

What resources do you have to work with? Savings, registered savings, existing home equity can all be utilized in investment strategies.

Don’t have any money? It’s actually not a problem. There are many ways to get started in investing even if you don’t have money saved up.

06

Property Types / Asset Classes

There are many types of properties (also called asset classes)

Residential: Single Family Homes, Multi-Family (Duplex, Triplex, Multiplex), Mixed-Use, Condo, and others.

Commercial: Office, retail, industrial, and many others

07

INvestment Strategy

You could say every person has their own strategy because there isn’t any one strategy that is better than the others. It really is about you and your interest and all the things in this blog post. But there are some main ‘categories’ of investing that you can think about:

- Buy and Hold: purchase an income property and hold it for many years

- Buy, Uplift and Hold: buy an undervalued property, fix it up to increase its value and income potential, then hold it for the long term

- Flip: buy an undervalued property, fix it up to increase its value and sell it for a profit

- House Hack: pay for your own home – buy a home with one or more income suites, live in one, and rent out the others

- BRRRR: Buy, Renovate, Rent, Refinance, Repeat – buy an undervalued property, fix it up, rent it, refinance at a higher appraised value, use profits to repeat in a new property (while still owning the first).

08

Markets

An important key to success is to align your goals and interests with markets that can serve those interests. Sure, it’s possible to invest in Toronto and the GTA but some strategies will be much more difficult. Cities and towns outside the GTA are great places for some strategies. And, it is completely possible to own properties that you never visit outside the GTA or even other provinces.

If you want to learn more or have any questions,

I would be happy to have a conversation with you.