How does Real estate Build Wealth?

There are many ways that Real Estate can build wealth but they all come down to 3 essential mechanisms by which your investment in property provides you with a return.

Why is this important?

- Set Your Goals accordingly

- Evaluate an Investment using all three

- How does increasing/decreasing one affect the other?

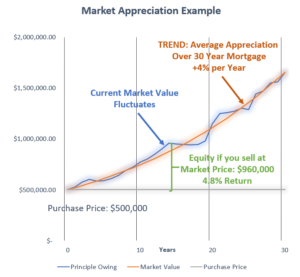

1. market Appreciation

This what most people think about and what the media tends to focus on with respect to real estate. That is, what is the current value of this property in this market?

- Anything more than what you have paid is appreciation (i.e. more wealth to you!)

- Market value fluctuates based on macro factors like the economy and localized factors like the condition of the property.

- The market trend for most properties in Canada is that property appreciates over time.

- Bottom line: simply holding onto a property will increase your wealth over time.

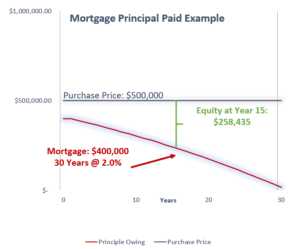

2. MortGAGE Principal Paid

Your mortgage payment is comprised of two parts: the interest and the principal. Interest is the fee your lender is charging you to borrow their money. The principal represents the actual loan and each payment of principal reduces the loan left owing on the mortgage.

- Principal paid is your ownership in the property, i.e. your equity

3. Property Income

A third way that Real Estate can build wealth is to provide income to you through charging people rent and fees for other property services such as parking, laundry, utilities.

- If the total amount of income is greater than the property’s expenses including the mortgage payment, property taxes. and utilities, then the property can be said to be ‘Cash Flow Positive’.